California had a different election from the rest of the U.S. It provides a unique opportunity to improve on, rather than spew about repealing, the federal health reform.

California had a different election from the rest of the U.S. It provides a unique opportunity to improve on, rather than spew about repealing, the federal health reform.

The spin that favoring health reform killed off the defeated incumbents in the House is way overblown to start with, since most of the Democrats who voted against the reform also got whacked by voters. This election's arm-waving accusations about "death panels" and the destruction of Medicare were flat-out lies, believed by those longing for reasons to be angrier. Health reform was also a very distant second to the economy in voters' minds.

A more complicated and true disappointment of the federal health reform is that it's based on requiring people to purchase insurance from the largely for-profit health insurance industry. Yep, more people may be insured, but the tsunami of double-digit premium increases this year shows how insurance companies will treat all of their customers. This private-sector mania is also the best argument for California's new crop of elected officials to push for health reform as it might have been, before insurance lobbyists in Washington crippled it.

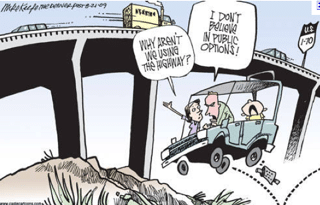

Remember the "public option"–a sort of optional Medicare for all? Lost to lobbyists who also seemed ready to argue that local contractors should run the highway system and private mercenaries should replace police departments. How about at least tough regulation of insurance rate increases with the right to disapprove them? Swept away in conference rooms. Yet both are realistic goals in California.

The state Legislature has twice passed Legislation calling for statewide Medicare-style health care (if not funding for it), and twice considered a bill requiring the state insurance commissioner to review and approve health insurance rates before they go into effect. Both fell victim to vetoes, veto threats and fake "alternatives" by Gov. Arnold Schwarzenegger, in conjunction with a big-spending health insurance lobby that permanently resides in the Capitol. Things are different, as of today:

- The newly elected state insurance commissioner-to-be, state Assemblymember Dave Jones, was chief sponsor of two health insurance rate regulation bills, and a strong supporter of statewide public insurance.

- Gov.-elect Jerry Brown doesn't have much current track record on health reform, but certainly wouldn't veto rate regulation, which comes at little cost to the state, or twist arms in the Legislature against it. He would likely balk at trying to fund a statewide single-payer health plan while the state is crushed under a budget deficit. But there's much less fiscal downside and real savings in a public option–a publicly owned nonprofit health plan that competes on level ground with private insurers. If the public option is cheaper and better, people will vote with their dollars for expanding it.

- The federal health reform positively encourages states to innovate beyond the law, inviting them, under "State Flexibility to Develop Alternative plans," to use their federal funds for their own health care delivery plans, as long as the benefits and results are statistically equal to or better than the federal reforms.

Insurance companies are certainly thinking all the same thoughts, after spending $4 million to help Jones' opponent, while not disclosing their corporate involvement in the election. Now they'll ramp up their lobbying in key insurance committees in the state Senate and Assembly. They're making up their contribution lists for members of those committees.

But Blue Cross and friends have made insurance money harder to accept and insurers' arguments much harder to even pretend to believe. Enraged California consumers forced the current insurance commissioner to examine unjustifiable 2009 rate hikes, finding "math errors" (yeah, sure) in favor of the companies. United Health Group just reported booming profits, while the whole industry blamed its rate hikes on health reform. Insurance money should now be as popular as tobacco money in Sacramento.

For Jones, Brown and legislators, opposing the insurance industry should be a lot less dangerous. Voters, especially in California, have gotten too many reminders that what the insurance industry cares about is its bottom line, not better health care.