The health insurance industry is running a no-holds-barred campaign to evade consumer protections in the federal health reform law that require them to reduce salaries, waste and other overhead and spend most of our premiums on medical care. Insurers have been attacking the rule directly in the states, where they're lobbying insurance commissioners to apply for a blanket exemption, and indirectly through the National Association of Insurance Commissioners (NAIC), where they've convinced some commissioners with industry ties to back a move that would preserve high paychecks for insurance agents by removing their salaries from any requirement for insurers to reduce waste.

The health insurance industry is running a no-holds-barred campaign to evade consumer protections in the federal health reform law that require them to reduce salaries, waste and other overhead and spend most of our premiums on medical care. Insurers have been attacking the rule directly in the states, where they're lobbying insurance commissioners to apply for a blanket exemption, and indirectly through the National Association of Insurance Commissioners (NAIC), where they've convinced some commissioners with industry ties to back a move that would preserve high paychecks for insurance agents by removing their salaries from any requirement for insurers to reduce waste.

Senator Jay Rockefeller sent a letter to the NAIC yesterday opposing the move that's a must-read for anyone who doesn't understand what's at state for consumers.

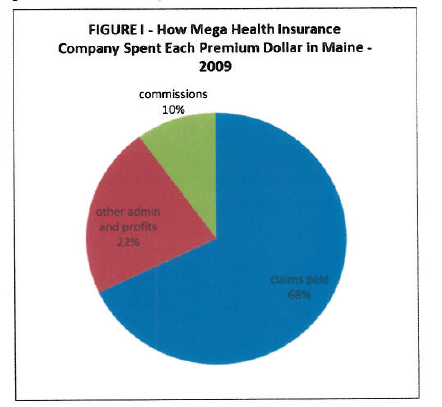

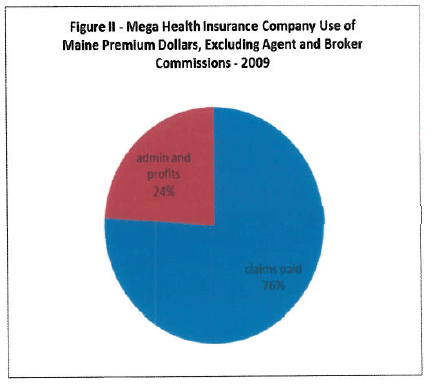

I'll post just one of his examples, an accounting of broker payments by junk health insurer Mega in Maine:

Mega spent 10% of consumer premiums on commissions in 2009, and would owe approximately $3 million in rebates to consumers under the current rules.

If the rules changed, and Mega were allowed to exclude agent commissions from its administrative costs, that rebate would fall approximately 60% to $1 million.

Now this particular example is moot, because HHS decided to grant Mega in Maine a blanket exemption from the rule for the next three years (more on this here). But this is one of the few cases where we have hard numbers on how much of a company's premiums goes to agent fees. And it gives us an easy illustration of how excluding agent commissions from the medical loss ratio will allow some insurers to maintain higher profits without increasing efficiency or spending a penny more on patient care. The NAIC would be eviscerating the medical loss ratio regulation they spent six months drafting (and until now got some applause for fair dealing) if they back the proposed legislation.

You can read our press release on the issue here, and download Senator Rockefeller's letter here. Expect more from Consumer Watchdog's Judy Dugan when she travels to Austin to watchdog the regulators where the NAIC meets next.