The worst definitely didn’t happen in Seattle. The National

Association of Insurance Commissioners deferred the

worst insurance industry demands for weakening the implementation of

health care reform. For a body so closely linked to the insurance

industry, that counts as real progress. Credit is due to the

state-level experts who wrote proposed regulations, the consumer representatives and advocates who monitored the process,

pressing for more consumer-friendly interpretations, and some state commissioners who put consumer protection over politics.

Battles

over how insurance companies will account for taxes and perhaps broker

fees (sales commissions) are still to come, but what emerged from the

meeting was a relief–there were few changes to the proposals devloped

by NAIC staff and state insurance analysts and actuaries. One really

irritating proposal to let insurers count their accreditation

fees–which are meant to reassure investors and employers–in the

health care eaquation was even deleted.

Rather than rewrite the

Rather than rewrite the

book, I’ll offer the statement issued by Health Care for America Now,

which mounted demonstrations with a local affiliate during two days of

the conference. Highlights included "lobbyist disinfectant: kits with

soap and a mask, a band playing health-reform tunes and a giant

blood-sucking Dracula meant to represent–what else?–insurance

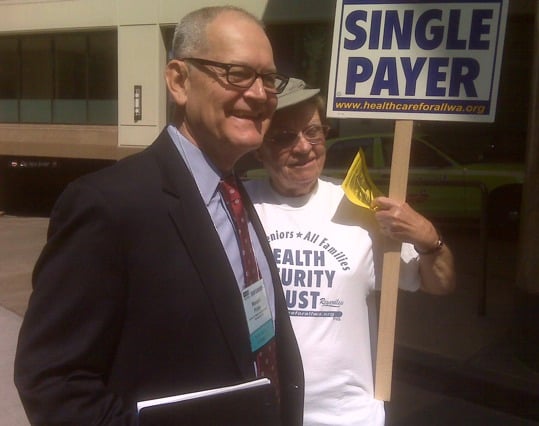

companies. Here’s a photo of one demonstrator hugging

whistleblower-hero Wendell Potter, who was active at the meeting.

Sorry, I missed the Dracula shot.

“Today the NAIC took a step toward ending the health insurance

companies’ stranglehold on our health care. The top state insurance

regulators from across the nation voted to put patient care above

insurance company profits. This decision moves us closer to more

affordable health care for families and businesses and will help ensure

that the new health care law fulfills its promise. Advocates have

battled every step of the way to hold the insurance companies

accountable, and we will continue to do so.“Many challenges remain before we can declare victory in the MLR fight.

Pivotal aspects of the technical rules discussed today in Seattle

remain unresolved, including crucial decisions on how to treat federal

taxes and agent/broker fees. The NAIC still has work to do, and it

should finish its deliberations soon so the Department of Health and

Human Services (HHS) can swiftly develop final rules that take effect

on schedule for 2011 health plans.”

MLR, by the way, means "medical loss ratio." That’s insurer-speak

for how much the companies spend on health care, rather than

administration and profit–and it’s such a telling phrase. Health

reform is supposed to require insurers to spend 80% to 85% of premium

dollars on health care–the MLR. But it all depends on how you define

health care, and how much you can deduct from premium revenue before

you calculate the percentage. That particular battle is way far from over.