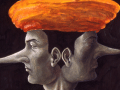

Health insurance companies apparently have no problem taking opposite sides of an issue when it serves their bottom line. When it comes to California law, they hate regulation and will spend any amount of money and credibility to kill it. But when it comes to protecting the profits of insurance brokers at the expense of consumers, insurance companies say (approvingly) that effective state regulation will protect consumers from premium increases. Both positions are public record, but health insurance companies apparently figured no one would ever notice.

Health insurance companies apparently have no problem taking opposite sides of an issue when it serves their bottom line. When it comes to California law, they hate regulation and will spend any amount of money and credibility to kill it. But when it comes to protecting the profits of insurance brokers at the expense of consumers, insurance companies say (approvingly) that effective state regulation will protect consumers from premium increases. Both positions are public record, but health insurance companies apparently figured no one would ever notice.

The California battle is highly public. The state is the biggest health insurance market in the nation and one of the least-regulated. So it's no wonder tht the insurance industry is fighting a tooth-and-nail battle against state regulation that would protect consumers from premium increases of up to 86% in 12 months–as Blue Shield tried to impose in the last year. The insurance companies have clubbed doctors into submission, threatening to cut their reimbursement if decent regulation starts to squeeze record health insurance profits. They have also poured money into political contributions to key legislators, according to an Associated Press story this week.

The bill, AB 52 by Assemblyman Mike Feuer, has passed the state Assembly and is up for a vote today (Wednesday) in a key state Senate committee. Here's a safe bet: Even if it passes and goes to the full Senate, insurers will twist every arm and make every threat to get the bill killed–or more likely, crippled by hostile amendments that would hogtie the state Insurance Commissioner.

The other side of the insurance company mouth is buried in the proceedings of the National Association of Insurance Commissioners, where only geeks go to read. Right now the organization is under pressure to back a legislative proposal in Congress that would kill a key consumer protection in the federal health reform. The bill, HR 1206 by Michigan Republican Mike Rogers, would allow insurance companies to pay brokers and agents without counting the payments as an overhead expense. This would trash the reform requirements that insurance companies spend more on health care, holding overhead and profits to 15% or 20% of insurance premiums. If they don't have to count broker pay as overhead, health insurers wouldn't have to lift a finger to become more efficient.

Of course, we consumer advocates have argued that if the Rogers bill passes, insurance companies will have a free pass to raise premiums.

The health insurance lobby's response? Oh, that won't happen because consumers are well-protected by state insurance regulations!

From a June 2 letter (see last page) by America's Health Insurance Plans to the NAIC:

"Finally, we wish to comment on a concern we have heard that deserves a response. One commentator has expressed the concern, and assumption, that if commissions are removed from the MLR calculation, then insurers will only increase their premiums – leading to great harm to consumers. We believe this flawed assumption fails to recognize the standard of rate review prevalent in the states. Exempting commissions from the MLR calculation does not pull them from the rates, and certainly does not stimulate insurers to inflate their rates. And states are increasingly focused on assuring value for consumers in their rate review, in accordance with the ACA, making such an assertion even more unlikely.”

If states want to "assure value" in health insurance, they certainly do have to review and regulate rates, and that includes the power to approve or reject rates before they go into effect. Such prior approval is now "prevalent" in the majority of states–though not in California.

When a corporate lobby is as powerful as the health insurance industry's, it apparently doesn't have to worry about being consistent.

I hope state legislators weighing the California bill have a grip on how two-faced the industry deliberately is. At least the industry has admitted that regulation is the only barrier between consumers and the next flood of premium increases.