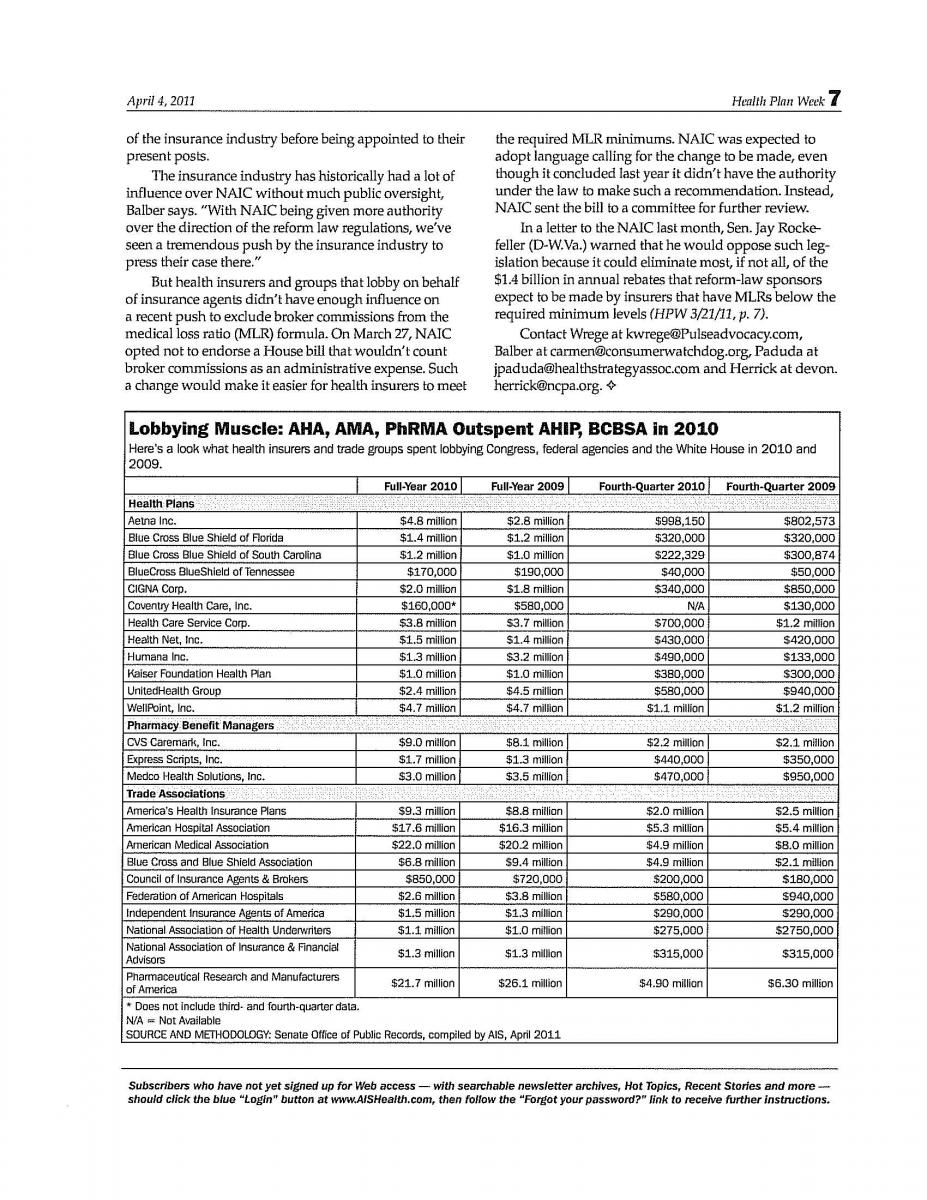

From a financial standpoint, 2010 was a great year to be a lobbyist. Health insurers, providers, pharmacy benefit managers (PBMs) and trade groups with an interest in shaping health policy spent a staggering $122.8 million lobbying Congress, the White House, HHS and other federal agencies in 2010, according to HPW’s analysis of documents released recently by the Secretary of the Senate as required under the Lobbying Disclosure Act. Spending, however, is down slightly from the $127.8 million the same organizations spent in 2009 (see table, p. 7). Industry observers queried by HPW say more lobbying will be directed at state lawmakers and regulators going forward.

While the trade group America’s Health Insurance Plans (AHIP) sunk more money into its federal lobbying efforts in 2010 ($9.3 million) compared with 2009 ($8.8 million), spending by the Blue Cross and Blue Shield Association (BCBSA) decreased from $9.4 million in 2009 to just $6.8 million in 2010. Carmen Balber, director of California-based Consumer Watchdog’s Washington, D.C., office, says the decrease in federal lobbying dollars likely indicates a shift toward a bigger push to influence state rules that can impact Blues plans.

“We definitely expect to see a big increase in health insurance lobbying at the state level. And I think we’re already seeing that as states debate how to set up and regulate [insurance] exchanges and how to regulate” proposed insurance rate hikes, she says.

During the year-long debate over health reform legislation, insurers and their trade groups were largely focused on influencing rules that could have a negative impact on their business model. Their efforts were effective at quashing a federally backed public health plan option, which was perceived as a top threat. With the reform law now in place, the industry is turning at least some of its attention to the states.

“Insurance regulation is mostly a 50-state patchwork, where each state has the right to regulate insurance within its borders,” says Devon Herrick, Ph.D., a senior fellow with the Republican-leaning National Center for Policy Analysis. “Now that the federal legislation has been signed into law, insurers now must get back to paying attention to what the states are doing.”

Industry consultant Kevin Wrege agrees and says that because states play such an integral part in how the federal reform law is implemented, the trade groups — and to some extent individual insurance companies — “are looking to more fully integrate their federal advocacy efforts with their state advocacy efforts,” he says. “I agree that there is more energy being focused on state efforts particularly now that the law has been enacted. But there are still important regulatory decisions to be made at the federal level.” Wrege is president of Washington, D.C.-based PULSE Issues & Advocacy LLC and a consultant for the health insurance industry-backed Council for Affordable Health Insurance (CAHI).

But it can be difficult, if not impossible, to track where lobbying dollars are spent at the state level because reporting disclosure rules vary considerably from state to state. Moreover, the National Association of Insurance Commissioners (NAIC), which has significant sway in helping HHS define reform-related regulations, isn’t required to report money spent lobbying its internal staff, Balber contends. “In California, for example, a health insurer would have to report money spent lobbying the state insurance commissioner. However, that’s not the case for the professional staff at NAIC. And that staff is responsible for influencing a lot of the regulations.”

NAIC did not respond to a request for comment on that statement by HPW’s press time.

Insurers Outspent by Other Trade Groups

In 2009 and 2010, representatives for more than 1,200 organizations lobbied on the health reform bill, according to the Center for Responsive Politics.

In 2010, 12 of the nation’s largest health insurers collectively spent $24.4 million on federal lobbying efforts, while AHIP and BCBSA spent an additional $16.1 million. But trade groups that represent providers and PBMs had even deeper pockets. The American Hospital Association, for example, spent $17.6 million on lobbying in 2010 — $1.3 million more than in the previous year — and the American Medical Association directed $22 million toward its lobbying efforts, down slightly from 2009.

Much of the lobbying done by those two groups was related to Medicare and Medicaid.

And while the Pharmaceutical Research and Manufacturers of America trimmed its lobbying budget by more than $4 million from the prior year, it still spent $21.7 million in 2010.

In January — less than two weeks after formally ending her role as Oklahoma’s Insurance Commissioner — Kim Holland began a new role as the Blue Cross and Blue Shield Association’s (BCBSA) executive director responsible for state affairs (HPW 1/17/11, p. 4). Critics assailed the lack of a “cooling off” period after her position as a regulator ended. Consumer Watchdog says 24 state insurance commissioners worked in some segment of the insurance industry before being appointed to their present posts.

The insurance industry has historically had a lot of influence over NAIC without much public oversight, Balber says. “With NAIC being given more authority over the direction of the reform law regulations, we’ve seen a tremendous push by the insurance industry to press their case there.”

But health insurers and groups that lobby on behalf of insurance agents didn’t have enough influence on a recent push to exclude broker commissions from the medical loss ratio (MLR) formula. On March 27, NAIC opted not to endorse a House bill that wouldn’t count broker commissions as an administrative expense. Such a change would make it easier for health insurers to meet the required MLR minimums. NAIC was expected to adopt language calling for the change to be made, even though it concluded last year it didn’t have the authority under the law to make such a recommendation. Instead, NAIC sent the bill to a committee for further review.

In a letter to the NAIC last month, Sen. Jay Rockefeller (D-W.Va.) warned that he would oppose such legislation because it could eliminate most, if not all, of the $1.4 billion in annual rebates that reform-law sponsors expect to be made by insurers that have MLRs below the required minimum levels (HPW 3/21/11, p. 7).

Contact Wrege at [email protected], Balber at [email protected], Paduda at [email protected] and Herrick at [email protected].