If you're wondering what happened to cheap U.S. fuel, look to Mexico, Canada and even OPEC member Venezuela.

If you're wondering what happened to cheap U.S. fuel, look to Mexico, Canada and even OPEC member Venezuela.

U.S. refiners are selling diesel and gasoline to those and other countries at historically high levels, making the nation a net exporter of fuel for the first time since 1949, according to the Energy Department.

Such enthusiastic exporting is one of the reasons that gasoline and diesel prices have been so high, energy experts say. Consumer advocates see it as harming motorists because gallons exported aren't available to U.S. gas pumps.

But refiners defend the practice as a necessary profit booster that benefits suppliers, workers and shareholders, such as retirement funds.

The export flow includes California, where refinery problems recently left fuel supplies and production near five-year lows and brought a new record average of $4.671 for a gallon of regular gasoline.

The U.S. is "meeting demand for fuels on a worldwide basis today," said Thomas Munger, vice president of FuelQuest Inc., a Houston energy consulting firm. Countries with growing fuel demands, such as Mexico, Costa Rica, Guatemala and others, "want what has been perfected in the U.S. from a technology standpoint. That's the ability to make any and all grades of fuel."

Few are as bullish about exports as William R. Klesse, chief executive of Valero Energy Corp., which owns two gasoline refineries in California. The San Antonio company has captured as much as 25% of the U.S. fuel export market, where strong demand means bigger earnings, Klesse said at a recent investors conference.

"It's not the way some people have represented it," Klesse said. "The markets are actually pulling it, and we actually make more money going to the export market."

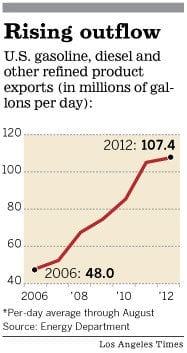

U.S. exports of all finished refined petroleum products, including gasoline and diesel, have risen more than 123% since 2006, to an average of more than 107 million gallons a day through the first eight months of this year. Mexico was the leading destination, followed by Canada and the Netherlands, and exports go to even unexpected places such as Venezuela, a member of the Organization of the Petroleum Exporting Countries, which has more oil than it has the ability to refine it.

California exports aren't broken out separately, but the smaller U.S. Customs districts are, and those statistics show a sizable export flow out of the state's biggest ports. A total of 37.9 million gallons of gasoline and 117.9 million gallons of distillates, including diesel, were exported in July via the Los Angeles, San Francisco and San Diego customs districts, according to Commerce Department and Energy Department statistics.

To the energy industry, the shift of products to foreign markets makes perfect sense from a business standpoint.

"Any time the U.S. produces more than it consumes of any commodity and is able to sell the excess in the world's market, it is a plus for us," said Rayola Dougher, senior economic advisor for the American Petroleum Institute.

"It means jobs for Americans, economic growth and a lower trade deficit," she said. "We should no more think to stop our refiners from exporting their products than we would think to ask our farmers" to stop exporting.

Chevron Corp.'s top refining executive recently explained to Wall Street investors that the San Ramon, Calif., company's two California refineries "form the backbone of a very competitive network, performing well under a variety of market conditions."

"This includes exports to Asia and Latin America when such opportunities arise," said Michael K. Wirth, Chevron's executive vice president for downstream and chemicals.

The refiners also argue that exports are keeping American refinery workers employed at plants that didn't have to be shut because of low fuel demand in the U.S. In addition, the industry says, refiners export fuel not needed by the U.S. market.

"First and foremost, California refineries are going to make the fuels needed for California, Arizona and Nevada, and then they will look for markets for their products outside the U.S," said Tupper Hull, spokesman for the Western States Petroleum Assn.

Still, some analysts point to exports on top of lean refinery fuel inventories as a factor in price surges when refinery problems pop up.

Energy expert Amy Myers Jaffe said fuel exporting removes gasoline and diesel that would otherwise be available to the market to mitigate price spikes.

"There is no such thing as 'surplus gasoline,'" said Jaffe, executive director of energy and sustainability at UC Davis. "It's a little like saying you are only going to take water from the shallow end of the pool. If I take water out, there is less water in the pool."

Jaffe advocates that California should have a minimum inventory standard of fuel, kept so that it could be tapped during supply emergencies. The fuel would have to be regularly rotated into circulation because, unlike oil, gasoline degrades over time.

Until California has a cache of fuel it can call on during unexpected refinery outages or emergencies, Jaffe said, "there is no circumstance in which exporting that gasoline helps us in any way."

Consumer advocates say drivers are being squeezed by refiners' vigorous exporting.

"Our refineries are being used to produce fuels and other petroleum substances to sell overseas," said Jamie Court, president of Santa Monica-based Consumer Watchdog. "We need the power to regulate the supply of gasoline in the state of California."

In a recent letter to California Atty. Gen. Kamala D. Harris, the Utility Consumers Action Network urged an investigation of what the San Diego group suspected was "intentional under-production of fuel to restrict supply," "overseas exports of gasoline" and "dumping fuel to restrict supply."

As evidence, the group's Charles Langley wrote, "Oil is selling for around $92 a barrel, yet gasoline prices here have been higher than they were when oil was selling for $147 a barrel in 2008."