An uprising in Libya is not causing your wallet to bleed at the gas pump. The U.S. buys virtually no oil from Libya. Egypt and Tunisia, the other hotspots, don’t even produce oil. There’s still a surplus of oil on world markets, more than enough to make up for any shortage from Libya.

An uprising in Libya is not causing your wallet to bleed at the gas pump. The U.S. buys virtually no oil from Libya. Egypt and Tunisia, the other hotspots, don’t even produce oil. There’s still a surplus of oil on world markets, more than enough to make up for any shortage from Libya.

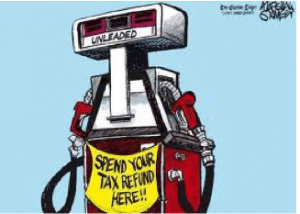

Fear and greed, expertly manipulated by billionaire speculators in oil markets, are much more to blame. Here are five ways to curb the speculators and oil companies. Nothing easy, like a gas station boycott. But more effective if the public voice can cut through the financial and oil lobbies.

The oil traders who are driving up prices are not selling oil or buying actual oil. They account for up to 80% of market trading in oil, but they don’t actually produce oil or take delivery of it, like airlines or heating oil dealers. They’re just gambling on the future price of oil and trying to drive it up for profit. Two months ago, there was no reason to be above $90 a barrel. There’s still no reason for it to be above that. Speculators love to gin up fear that sometime in the future there could possibly be an actual oil shortage. The same speculators also drive up food prices.

President Obama once promised reforms that would tame the gambling. But financial lobbies have stymied most of the regulation that would cut their gambling take from commodity markets.

Policy actions

1. President Obama, stop the speculators. The president is the boss of the should-be regulators at the Commodity Futures Trading Commission (CFTC), who are supposed to be setting rules that would slow down the purely financial speculation that is driving energy prices. Surely Obama knows that ordinary Americans can’t stand much more of unaffordable gasoline, heating oil and food. Yet it’s U.S. workers who are paying for energy speculators’ yachts and vacation homes. President Obama should be cracking heads at the CFTC, replacing some members if necessary to get the votes for regulation that is written but not approved by the CFTC.

We want the CFTC to make energy trades public, not secret, and establish strong “position limits,” in commodity markets, which would stop huge trades that drive the market up in a single day. We also want speculators–including oil companies–to put up at least 50% of the cost before they place a futures market bet, just like stock purchasers already do. Today, commodity speculators only put up cents on the dollar before they gamble. Just try that in Vegas. Making all these things happen could drop the price of oil by up to half.

Want to take personal action? Call the White House (202-456-1111). Someone at the other end does listen to and log the White House messages.

2. Release oil from the U.S. strategic reserve. This is another one that’s up to President Obama. Admittedly, there’s a 38-billion-gallon surplus of privately owned oil in storage tanks in Oklahoma pipeline country alone. But releasing oil from the public’s reserve would be a signal that Obama serious about pulling back oil prices that threaten economic recovery. The U.S. Treasury would also benefit from selling high.

Caution: This only works if he also gets serious about curbing speculation. All the more reason to call the White House yourself.

3. Get one single regulation past the CFTC. The Commodity Futures Trading Commission has done little but drag its feet on regulating financial markets, but it is finally taking comments on proposed position limits that would help curb speculators. But there are only two certain votes for it on the five-member committee. Even CFTCchairman Gary Gensler, an Obama appointee, hasn’t declared himself in favor. Big financial companies like Goldman Sachs, which profit from huge amounts of trading, hate it. They are flooding the CFTC with lobbyists and comments predicting disaster. OilWatchdog’s friends at the Commodity Markets Oversight Coalition, a group that ranges from gas stations to airlines to consumer watchdogs, is urging its members and the public to push back against the lobbyists. It has the instructions for commenting here. Also some talking points.

The oil refiners who produce gasoline routinely cut back their production of gasoline to keep supplies low and prices high. They make their biggest profits when oil prices drop a little, and sometimes just shut down refineries altogether to keep prices up. In 2007, refiners were making $1.00 a gallon in margin (mostly profit) as gasoline prices headed toward their last 2008 peak of $4.50 a gallon. It will happen again without better regulation.

Policy action:

4. Legislators should regulate refineries like public utilities. That means refiners would still make a steady if lower profit, but gaming the gasoline supply and gouging consumers would be prohibited. Refinery regulation would logically start with the states, but refiners and their parent companies (like Chevron, Exxon and BP) are a powerful state lobbying presence. Legislators, however, also know that $4.00 gasoline is a tipping point for the economy to fall back into recession. California is at particular risk, since it’s already hitting $4.00 for regular gas. If you’re in California, you can contact your state legislator here.

The nation is broke and investment in green energy that can replace fossil fuels is at risk. So why are taxpayers shelling out $3 billion to $4 billion a year in tax breaks and credits to oil companies that are again reaping record profits from skyrocketing oil prices? Answer: because oil companies want it that way. Consumers need to be louder than the lobbyists.

Policy action:

5. President Obama should keep submitting his proposal to cancel corporate welfare for oil companies, during the week that major oil companies report their quarterly profits. Consumers should let their members of Congress know that kneeling before the oil lobby is no longer bearable. Some or most of the money should go to green energy development and cleaner transportation: hybrid cars, electric cars, clean public transit and clean-diesel rail networks. Public policy that supports these technologies will ultimately make them as cheap as oil.

Of course we should all do our personal part, with lower-mileage cars, public transportation wherever it functions, biking to work. But government needs to get the foundation in order, resisting the big bucks of the oil and financial industries.