The reviled “jobless recovery” of the U.S. economy won’t improve much in 2012, say the usual forecasters. But oil company executives and market speculators can break out the champagne now as the price of crude oil starts the year with a huge jump–soon to be reflected at a gas station near you. Really, if the richest can just keep getting richer, why worry about the middle class?

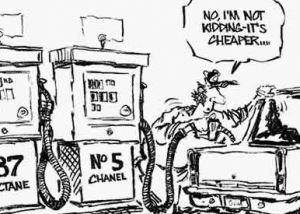

The price of gasoline in the U.S. set a full-year record in 2011, swiping $4,155 from the average family pocketbook, more than 8% of family earnings. Last year’s payroll tax cut that was supposed to stimulate the economy went largely to the pockets of OPEC, Exxon and friends.

Given the 4% jump in crude oil prices on Tuesday, the first trading day of the new year, 2012 looks like it could be even worse. What’s most shocking, however, is that effective government could put a stop to the price roller-coaster.

The news stories, parroting the financial analysts, blamed the mini-”Iran crisis” and economic growth in China, India and the U.S. for the oil price spike. But the truth is that Iran’s saber-rattling is nothing new and on-and-off embargos have already diminished the importance of Iranian oil in world markets. Just a week ago, oil prices fell slightly when the same analysts proclaimed Iran’s actions as “empty threats.”

Another truth is that growth in the U.S. and Asia is offset by the economic mess in Europe, where economies have shrunk and the risk of full economic meltdown persists. So worldwide oil demand is expected to be flat in 2012, and U.S. crude oil supplies are still well above what they were before the 2008 economic meltdown, according to U.S. Energy Information Administration data.

There is absolutely no supply and demand reason for crude oil prices to spike above $100 a barrel, or for families to fork over 8.4% of their income on gasoline to get to a worse-paying job than they had three years ago. The real reason remains speculation in oil markets, and a government so beholden to financial and corporate powers that it can’t respond in any effective way.